Understanding Double Materiality in ESG

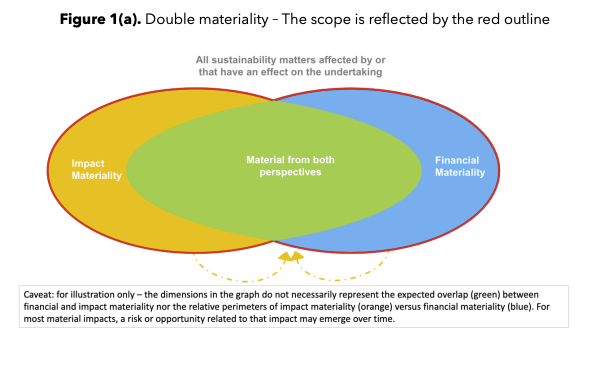

Double materiality is a fundamental concept in modern ESG reporting that helps organizations identify and prioritize the sustainability issues that matter most to their business and stakeholders. Unlike traditional materiality assessments that focus solely on financial impacts, double materiality takes a comprehensive approach by considering both how sustainability issues affect the company and how the company affects the world.

What is Double Materiality?

Double materiality requires organizations to assess sustainability matters from two complementary perspectives:

- Financial Materiality (Inside-Out): How sustainability matters affect the organization's financial performance, position, and prospects

- Impact Materiality (Outside-In): How the organization's activities impact people and the environment

This dual approach ensures that companies address not only business-critical sustainability risks and opportunities but also their broader responsibilities to society and the environment.

Double materiality reflects the growing recognition that business success and societal well-being are interconnected. Companies that ignore their broader impacts may face long-term business risks, while those that address both perspectives often discover new opportunities for value creation.

Financial Materiality

Financial materiality focuses on how sustainability matters can influence a company's financial performance, both positively and negatively. This perspective examines the business case for sustainability action.

Financial Materiality Characteristics

- Revenue Impact: How sustainability issues affect sales, market share, and pricing power

- Cost Implications: Direct and indirect costs arising from sustainability matters

- Risk Management: Financial risks that could materially affect business operations

- Investment Requirements: Capital needed to address sustainability challenges or opportunities

- Regulatory Compliance: Financial implications of current and anticipated regulations

Examples of Financial Materiality

Climate Change

- Physical Risks: Extreme weather events disrupting operations and supply chains

- Transition Risks: Carbon pricing, stranded assets, and changing consumer preferences

- Opportunities: Energy efficiency savings, green product premiums, access to sustainable finance

Social Issues

- Talent Retention: Workplace culture impacts on recruitment and retention costs

- Customer Loyalty: Social practices affecting brand value and customer relationships

- Operational Efficiency: Employee engagement driving productivity and innovation

Governance Factors

- Regulatory Fines: Non-compliance costs and legal liabilities

- Investor Confidence: Corporate governance quality affecting cost of capital

- Operational Risk: Poor governance leading to business disruptions

Assessing Financial Materiality

-

Quantitative Analysis:

- Calculate potential financial impacts using scenarios and modeling

- Assess probability and magnitude of risks and opportunities

- Consider timeframes: short-term (1-3 years), medium-term (3-10 years), long-term (10+ years)

-

Qualitative Assessment:

- Evaluate strategic importance to business model

- Consider stakeholder expectations and market dynamics

- Review regulatory trends and competitive landscape

A manufacturing company identifies water scarcity as financially material because:

- Direct Costs: Increasing water prices in drought-affected regions (+15% annually)

- Operational Risk: Potential production shutdowns during severe droughts

- Regulatory Risk: New water usage restrictions affecting permits

- Opportunity: Water efficiency investments reducing costs by 20% over 5 years

Impact Materiality

Impact materiality evaluates how an organization's activities, products, services, and business relationships affect people and the environment. This perspective focuses on the organization's contribution to sustainable development.

Impact Materiality Characteristics

- Environmental Impacts: Effects on climate, biodiversity, pollution, and resource depletion

- Social Impacts: Effects on human rights, labor conditions, community development, and health

- Value Chain Considerations: Impacts throughout the entire value chain, not just direct operations

- Positive and Negative Impacts: Both beneficial and harmful effects on society and environment

- Actual and Potential Impacts: Current impacts and those that could occur in the future

Dimensions of Impact Assessment

Scale of Impact

The severity or intensity of the impact on people or the environment.

- High Scale: Significant harm or benefit affecting core human needs or critical environmental systems

- Medium Scale: Moderate effects that are noticeable but not critical

- Low Scale: Minor effects with limited consequences

Scope of Impact

The extent or reach of the impact - how many people or how much of the environment is affected.

- Widespread: Affecting large populations, communities, or ecosystems

- Limited: Affecting specific groups or localized areas

- Individual: Affecting particular individuals or small environmental areas

Irremediability

How difficult it is to restore the situation to its previous state.

- Irreversible: Permanent impacts that cannot be undone (e.g., species extinction, climate change)

- Difficult to Remedy: Impacts requiring significant time and resources to address

- Remediable: Impacts that can be relatively easily corrected or compensated

Examples of Impact Materiality

Environmental Impacts

- Climate Change: Greenhouse gas emissions contributing to global warming

- Biodiversity Loss: Operations affecting endangered species or critical habitats

- Water Pollution: Discharge affecting water quality in local communities

- Resource Depletion: Unsustainable use of raw materials

Social Impacts

- Human Rights: Labor practices in supply chains affecting worker safety and dignity

- Community Development: Operations affecting local economic opportunities and social cohesion

- Health and Safety: Products or operations affecting public health

- Education and Skills: Workforce development contributing to social mobility

Assessing Impact Materiality

-

Impact Identification:

- Map all potential impacts across the value chain

- Engage with affected stakeholders to understand their perspectives

- Consider both direct and indirect impacts

-

Impact Evaluation:

- Assess scale, scope, and irremediability for each impact

- Consider cumulative and interconnected effects

- Evaluate both current and potential future impacts

-

Stakeholder Engagement:

- Consult with communities, NGOs, employees, and other affected parties

- Understand different perspectives on impact significance

- Validate impact assessments with external experts

A textile company identifies worker safety in suppliers as impact material because:

- Scale: Workplace accidents can cause severe injury or death

- Scope: Affects thousands of workers across multiple supplier facilities

- Irremediability: Health impacts from workplace accidents can be permanent

- Stakeholder Concern: High priority for workers, NGOs, and communities

The Intersection of Financial and Impact Materiality

Many sustainability issues are material from both financial and impact perspectives, creating powerful business cases for action:

Synergistic Topics

Issues that score high on both financial and impact materiality often represent the most critical sustainability priorities:

- Climate Change: High financial risks and significant environmental impact

- Supply Chain Labor Practices: Reputational and operational risks plus human rights impacts

- Product Safety: Legal liabilities and consumer health impacts

- Water Management: Operational risks and environmental/community impacts

Single Materiality Topics

Some issues may be material from only one perspective:

- Financial Only: Market-specific regulatory changes with limited broader impact

- Impact Only: Local community issues with minimal financial implications for the company

Even topics that appear to be single materiality should be regularly reassessed, as changing stakeholder expectations and regulatory environments can shift their materiality status over time.

Regulatory Context and Standards

European Union CSRD

The Corporate Sustainability Reporting Directive requires double materiality assessment for:

- Large companies (500+ employees)

- Listed SMEs (from 2026)

- Non-EU companies with significant EU operations

Global Reporting Standards

- GRI: Emphasizes impact materiality with stakeholder engagement

- SASB: Focuses on financially material sustainability factors

- TCFD: Addresses climate-related financial risks and opportunities

- TNFD: Extends TCFD approach to nature-related dependencies and impacts

Benefits of Double Materiality Assessment

- Comprehensive Risk Management: Identifies both business risks and societal impacts

- Strategic Focus: Prioritizes sustainability efforts on the most critical issues

- Stakeholder Trust: Demonstrates commitment to broader responsibilities

- Regulatory Compliance: Meets evolving reporting requirements

- Innovation Opportunities: Reveals new business models and market opportunities

- Long-term Value Creation: Aligns business success with societal benefits

- Over-complexity: Don't let perfect be the enemy of good - start with key issues and refine over time

- Stakeholder Fatigue: Balance comprehensive consultation with efficient processes

- Static Assessment: Materiality changes over time - regularly update your assessment

- Internal Bias: Ensure external perspectives balance internal viewpoints

Double materiality assessment is not just a compliance exercise - it's a strategic tool that helps organizations understand their role in the broader sustainability transition while identifying material business opportunities and risks.